Startups and early growth companies are an asset class in their own right. Startups are young companies founded to develop a unique product or service, bring it to market and expand very quickly. Whereas a small business is more focused on creating and maintaining a constant and stable revenue stream. They are not necessarily trying to scale up in any way.

Reasons why startups raise money vary from acquiring inventory, hiring sales resources, marketing, and expanding the product. It is important to note that many high-growth companies initially burn capital before reaching profitability, which is a common characteristic of successful startups.

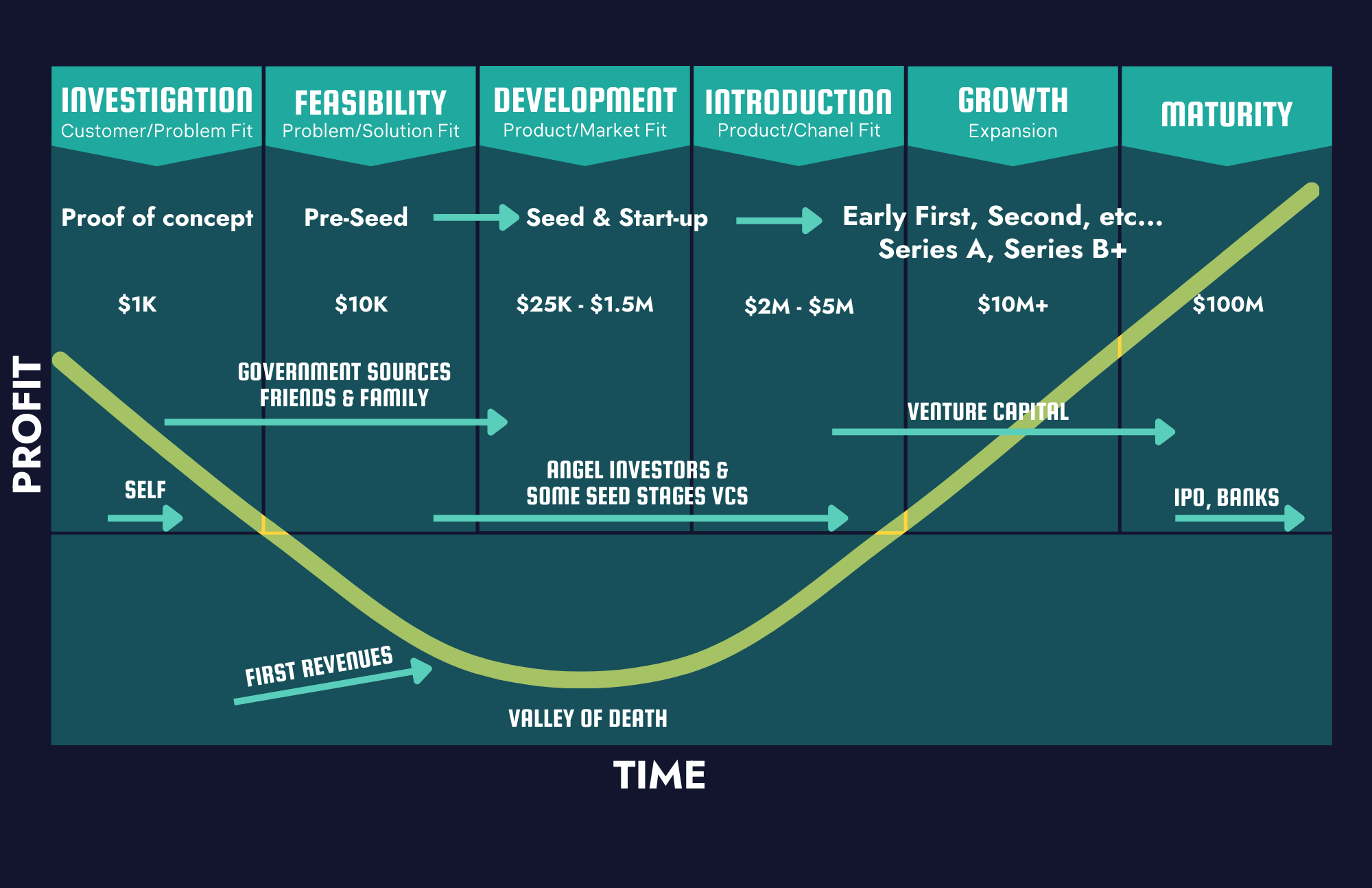

Most startups follow a common trajectory as seen in the image below. You will likely hear this graph referred to as a “hockey stick.” This refers to the checkmark-like shape that resembles the Canadian national symbol- the hockey stick.

As an angel investor, you will see noticeably young companies. Typically, when companies come to angels for investment it is when:

- They have proven to investors that the founders can realize their vision.

- The opportunity has a market large enough to expand in global markets.

- Identified and mitigated enough risks for investors to invest their money.

There are many reasons why start-ups succeed – and even more reasons why they fail.

As an investor, you will develop your own thesis based on your risk appetite, time horizons and personal beliefs and expertise. As you begin your journey, you will have to ask yourself various questions, such as:

- Does this investment align with your personal investment thesis and risk profile/criteria?

- How well do I know this industry?

- Is this the stage I like to invest at?

- Does it match my ethical preferences?

- Does this company have strong, defensible Intellectual Property?

- Would I be proud to invest in this company?

- Is the entrepreneur coachable? Do they listen to advice well?

At the end of the day, patience is really the key to all of this. The red flag is that when something is urgent, there are probably bigger problems. Everything takes time, and when it comes to investing in early-stage companies, it takes time to understand the problem and the solution that they are going through. Is it commercializing? Can it scale, can it grow rapidly? And is the founder and the team that they have the ones to do it and take it to where it needs to go?”

– Jeffrey Potvin, GTAN and York Angel Investor

Dive deep into the world of Angel Investing!

This value-packed blog post is part of our “Angel Investing 101” series that illuminates everything you need to know to drive right in! Read more in the “Angel 101” news series.