Ottawa Region Angel Group helps Seed Company ActivDox Identify IP and Market Opportunities

The mentorship and soon-to-be financial relationship between ActivDox (now SavvyDox) and Capital Angel Network (CAN) began at a CAN investment meeting. ActivDox was referred to CAN by Brian O’Higgins, a member of CAN. With significant references backing the company, CAN’s interest and mentorship ability amongst its members naturally came forth. Members of CAN took it upon themselves to perform in-depth due diligence, including interviews for the investors to validate the IP. For example, a connection was made with John Cronin, Managing Director of IPCapital, who helped formulate the strategy and content development of the provisional patent. This shared network led to a patent filing of four independent and 58 dependent claims.

Approximately six to eight members of CAN have indicated a soft interest to invest. Brian O’Higgins, a member of CAN, took particular interest in ActivDox by serving as a board member. Overall, CAN “brought a background in communications, security, and document management systems, which provided depth in qualifying opportunities to model our system after requirements that have high customer value,” says Founder & CEO David Thomson.

To date, the company is securing commitments for over $1M in Angel funding (from Ottawa, Waterloo, Toronto, and the United States), and are anticipating approval from FedDev for a $1M loan. ActivDox now has a queue of eight pilot customers awaiting proposals and a Secured Alliance teaming agreement with a leading outsource company to the US Federal Government for a first pilot with a government agency. Recruitment of employees is also underway to build a world-class software team in Waterloo. Although ActivDox is at the seed stage of development, multiple pilot opportunities are in formation stages across the healthcare, financial services, government policy and manufacturing industries.

Another aspect of Thomson’s unique approach is that while he is an alumni of the University of Waterloo (EE) and the University of Western Ontario (MBA), he lives in Overland Park, Kansas. He chose to create ActivDox in Waterloo and bring investment funds and talent to Ontario to grow ActivDox. Thomson also serves on the boards of Sandvine and Primal Fusion, both located in Waterloo.

ABOUT ACTIVDOX

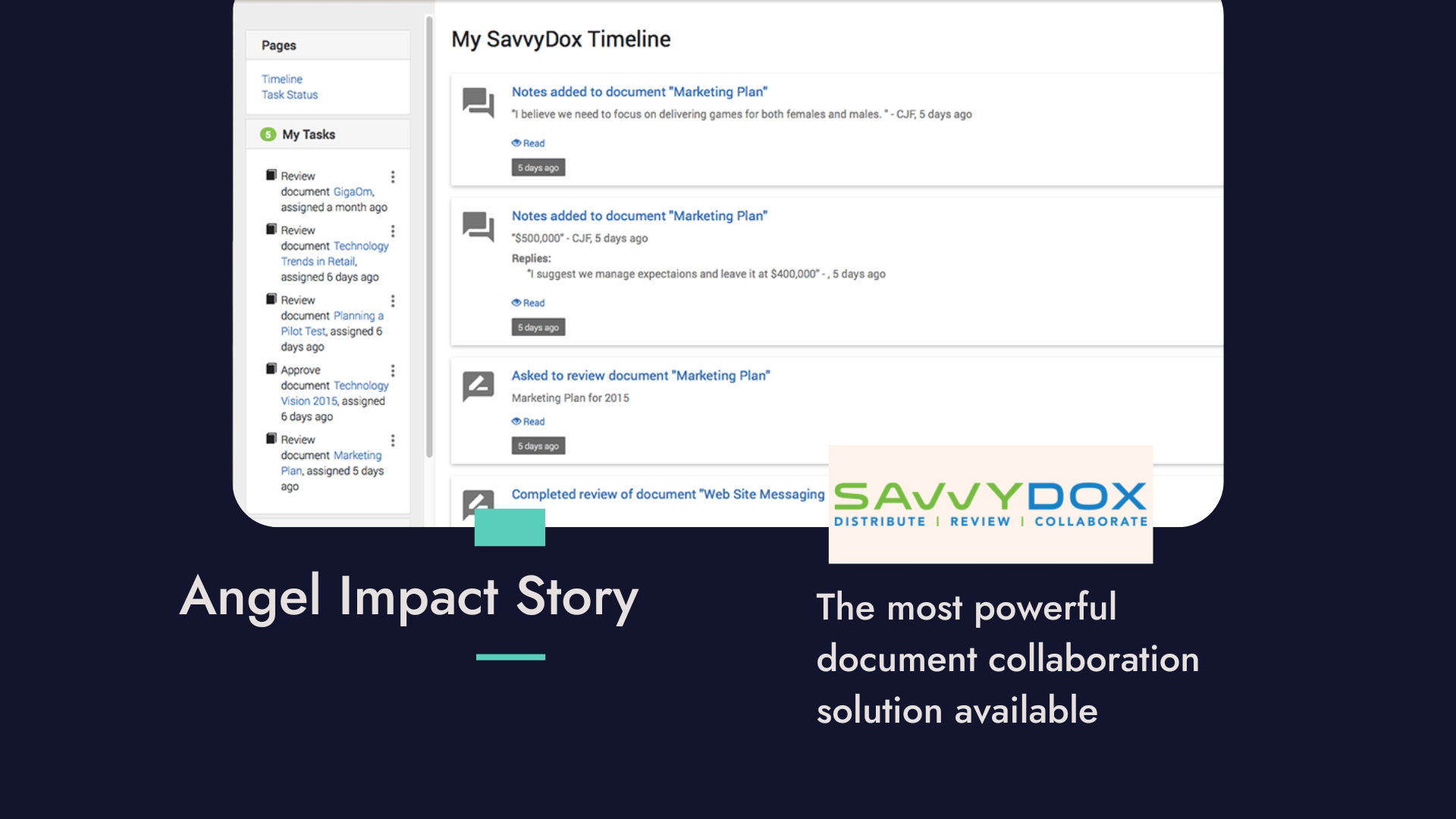

ActivDox is a new software company that aims to solve the leading-edge document management challenges on tablets: security, version control, and compliance challenges facing government and businesses of copyright content used in PDFs and eBooks. ActivDox is a new-age company that is targeting the convergence of mobile applications, digital content and cloud computing. In recent years, the anticipation for tablet devices presented a unique and very attractive market opportunity for advancements in document software. Founder and CEO David Thomson, author of the best-selling book “Blueprint to a Billion: 7 Essentials to Achieve Exponential Growth”, decided it was time to apply his leading research and insights to test and exploit the massive opportunity. Thomson’s approach to business building is, in some opinions, reversed when compared to traditional business strategies: he is building the business with an outside-in focus versus building a product, then looking for the market. The stages of development occurred as follows: 1) Identification of high-growth market segments, Marquee Customers’ unmet needs, high-order benefits, competitive offerings and qualified customers with a desire to pilot the new system; 2) Development of systems architecture to deliver a roadmap of capabilities and higher-order benefits, similar to the approach employed with Blackberry to the Blackberry Server; 3) Filing of provisional patents to secure intellectual property (IP) prior to the launch of the iPad; 4) Building an experienced and skilled Board of Directors; 5) Engage investors who had the ability to provide “smart money,” defined as investors who want to help secure pilots and alliance partners, as well as finance according to projected needs; and 6) Leverage investors to help identify world-class talent, either by association or active networking.

About Capital Angel Network

Launched in the spring of 2010 with support from Ontario’s Angel Network Program (ANP), Capital Angel Network (CAN) is a network through which accredited Angel investors can view pitches and collaborate with other Angels. CAN gives Angels in the Ottawa region a forum to hear other perspectives and receive feedback on their own before taking on any risk.